As businesses integrate carbon credits in their sustainability strategies, demand for high-integrity carbon creditsincreases. In 2026, the market is flooded with options, but not all credits deliver the same impact - or the same level of trust. The CCP label, a mark of excellence in the voluntary carbon market, helps buyers identify projects that meet rigorous standards for additionality, permanence, and transparency.

For companies serious about offsetting emissions without the risk of greenwashing, CCP-label credits are a gold standard. Below, we’ve curated the five best CCP-label carbon projects of 2026, each vetted for real-world impact and alignment with global climate goals. Whether you’re a sustainability leader, procurement specialist, or ESG investor, these projects deserve a place in your portfolio.

Why CCP-Label Carbon Credits?

The voluntary carbon market is evolving. With increasing scrutiny from regulators, media, and consumers, businesses can no longer afford to invest in low-quality credits. The CCP label, developed by the Carbon Credit Quality Initiative, provides a reliable framework to assess project credibility. To earn the label, projects must demonstrate:

Additionality: Proof that the carbon reductions wouldn’t have happened without the project.

Permanence: Assurance that the carbon benefits will last, with buffers for reversals.

Transparency: Clear, third-party-verified data on emissions reductions and co-benefits.

In 2026, CCP-label credits are particularly valuable for companies aiming to:

Strengthen ESG reporting with auditable, high-impact offsets.

Mitigate Scope 3 emissions in hard-to-abate sectors.

Align with emerging regulations like the EU Carbon Border Adjustment Mechanism (CBAM).

For organizations using Regreener’s proprietary analysis model, these projects represent the top 10% of the market—combining environmental integrity with measurable social and economic benefits.

The 5 Best CCP-Label Carbon Credits of 2026

1. Brusque Landfill Gas Project (VCS4138)

Location: Brusque, Brazil

Developer: Biofílica Ambipar

Methodology: Landfill gas capture and flaring

The Brusque Landfill Gas Project is a standout in the waste sector, capturing methane from a municipal landfill and converting it into clean energy. Methane, a potent greenhouse gas, is 28 times more harmful than carbon over a 100-year period, making this project a high-impact solution for immediate climate action.

Key benefits:

Reduces over 200,000 tonnes of carbon equivalent annually.

Improves local air quality and reduces health risks for nearby communities.

Generates renewable energy for the grid, displacing fossil fuel-based power.

Why it stands out: This project is one of the first in Latin America to use real-time monitoring technology, ensuring accurate measurement of emissions reductions. It’s ideal for companies with supply chain exposure in Brazil or those prioritizing UN Sustainable Development Goal 7 (Affordable and Clean Energy).

Best for: Retailers, manufacturers, and logistics firms with Scope 3 emissions in the region.

2. Project Loblolly (ISMV093)

Location: Mississippi, USA

Developer: The Nature Conservancy

Methodology: Improved forest management

Project Loblolly protects and sustainably manages over 10,000 acres of southern pine forest, a critical carbon sink. By preventing deforestation and promoting biodiversity, the project delivers long-term carbon sequestration while supporting local wildlife habitats.

Key benefits:

Sequesters over 500,000 tonnes of carbon equivalent over its lifetime.

Enhances resilience against climate change through sustainable timber practices.

Provides economic opportunities for rural communities.

Why it stands out: The project’s use of LiDAR technology for forest monitoring sets a new standard for transparency in nature-based solutions. It’s a top choice for businesses committed to science-based targets and nature-positive outcomes.

Best for: Corporations with nature-based carbon strategies, such as consumer goods or apparel brands.

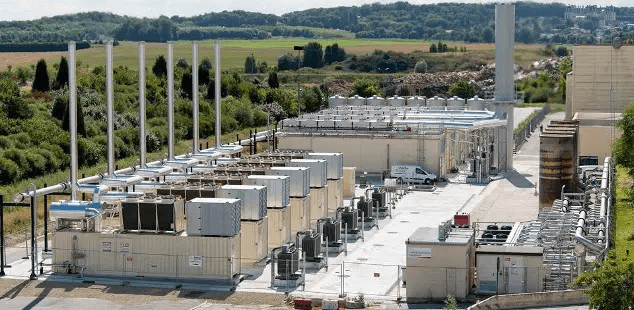

3. Laizhou Landfill Gas Power Generation Project (VCS2452)

Location: Laizhou, China

Developer: China Carbon Asset Management

Methodology: Landfill gas to electricity

China’s rapid urbanization has led to a surge in waste-related emissions. The Laizhou project addresses this by capturing landfill gas and converting it into electricity, powering thousands of homes while avoiding methane releases.

Key benefits:

Prevents over 150,000 tonnes of carbon equivalent from entering the atmosphere annually.

Supports China’s national carbon market and regional air quality goals.

Creates jobs in renewable energy and waste management.

Why it stands out: As one of the largest landfill gas projects in Asia, Laizhou offers scalability and compliance with China’s strict environmental regulations. It’s a strategic fit for multinational companies operating in or sourcing from China.

Best for: Tech, automotive, and industrial sectors with operations in Asia.

4. Reducing Gas Leakages in Hududgaz Gas Distribution Networks (VCS4531)

Location: Uzbekistan

Developer: Hududgaz

Methodology: Methane leakage reduction

Methane leaks from gas distribution networks are a major but often overlooked source of emissions. This project upgrades infrastructure across Uzbekistan, cutting leaks by 90% in targeted areas.

Key benefits:

Avoids over 100,000 tonnes of carbon equivalent per year.

Improves energy efficiency and safety for local communities.

Aligns with the Global Methane Pledge, a key initiative for short-term climate action.

Why it stands out: Few projects tackle methane leaks at this scale in Central Asia, making it a unique opportunity for companies with energy-intensive supply chains.

Best for: Oil and gas companies, utilities, and businesses with Scope 3 emissions in Central Asia.

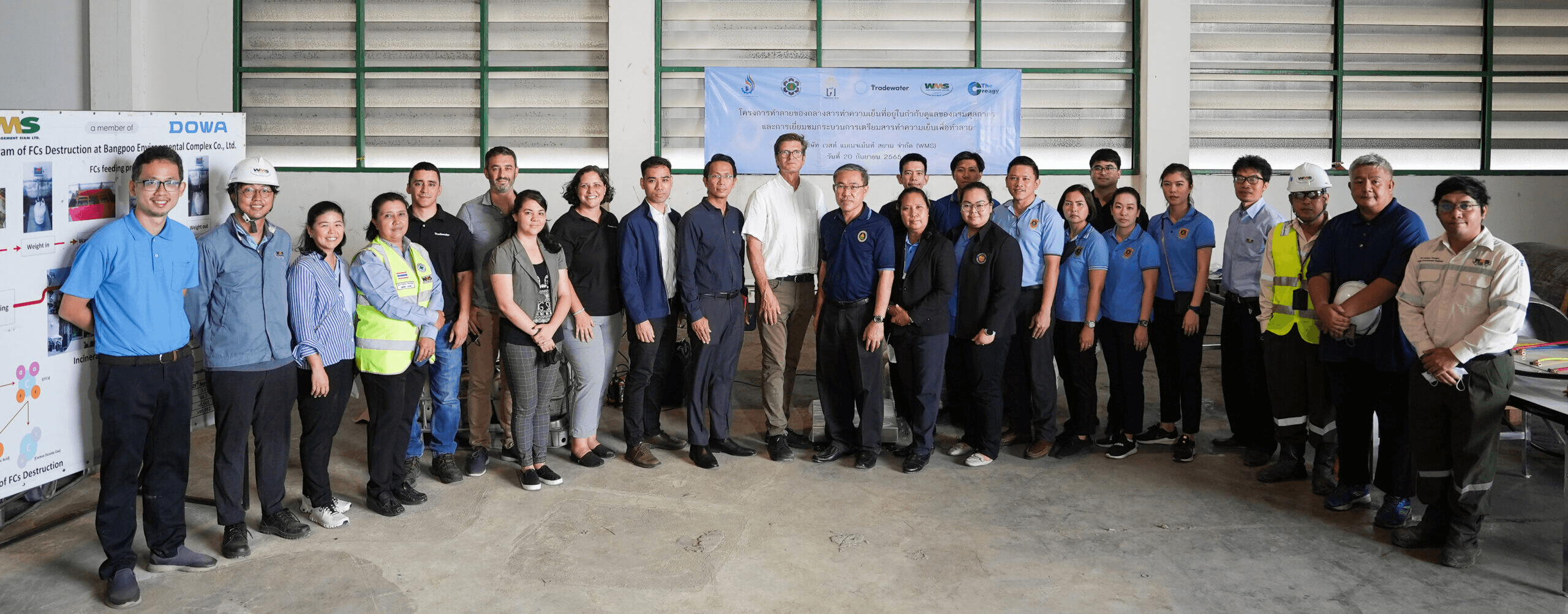

5. Tradewater – Thailand 6 (ACR937)

Location: Thailand

Developer: Tradewater

Methodology: Destruction of ozone-depleting substances (ODS)

Tradewater specializes in collecting and destroying refrigeration gases with extremely high global warming potential. The Thailand 6 project focuses on CFCs and HCFCs, preventing their release into the atmosphere.

Key benefits:

Eliminates the equivalent of 1 million tonnes of carbon over its lifetime.

Directly supports the Kigali Amendment to the Montreal Protocol.

Offers rapid, verifiable impact—ideal for companies with urgent offsetting needs.

Why it stands out: Tradewater’s serial-number tracking system ensures full traceability, from collection to destruction. This project is perfect for businesses seeking high-integrity, short-term carbon reductions.

Best for: Corporations with aggressive 2030 net-zero targets, such as tech giants and financial institutions.

How to Evaluate CCP-Label Carbon Credits

Not all CCP-label projects are created equal. To maximize the value of your investment, consider these factors:

Alignment with your climate strategy: Does the project address your most material emissions sources?

Co-benefits: Does it deliver additional social or environmental benefits, such as biodiversity protection or job creation?

Price and liquidity: Is the credit competitively priced, and can it be easily traded if needed?

Third-party verification: Has the project been validated by reputable standards like Verra (VCS) or American Carbon Registry (ACR)?

For a deeper dive, explore Regreener’s guide to carbon credit guide.

The Future of CCP-Label Credits

The carbon market is poised for significant changes in the coming years. By 2027, we expect to see:

Stricter regulations: Mandatory disclosure requirements for carbon credit buyers in the EU and US.

Technological advancements: Blockchain and satellite monitoring will enhance transparency.

Hybrid credits: Projects combining nature-based and tech-based solutions for greater impact.

As the market matures, CCP-label credits will remain a benchmark for quality. For businesses, the message is clear: prioritize integrity, diversify your portfolio, and stay ahead of regulatory curves.

Conclusion

The five projects highlighted here represent the best of the CCP-label carbon market in 2026—each offering a unique blend of environmental impact, social benefits, and strategic value. By integrating these credits into your sustainability strategy, you can confidently offset emissions while contributing to a low-carbon future.

Ready to take the next step? Contact Regreener to discuss how these projects can support your climate goals. Our team of experts will help you navigate the complexities of the voluntary carbon market and build a portfolio tailored to your needs.

For further reading, check out our 2026 Carbon Credit Buyer’s Guide or explore our case studies to see how leading companies are using CCP-label credits to drive change.